Mary Walker said she got a “bit of shock” when she opened up a piece of mail from the City of Toronto last month, informing her that she owed more than $2,500 in taxes for the “vacant” Scarborough condo where she currently resides.

She said she was hit with the unexpected tax bill after she failed to make her Vacant Home Tax declaration for 2023 and the city deemed her condo unoccupied.

“Obviously it is a bit of shock to get this kind of bill in the mail,” Walker told CP24.com on Thursday.

When Toronto’s Vacant Home Tax was first rolled out in 2022, she said she did go online and make the declaration.

“This year, I overlooked the fact that it said it was an annual thing,” Walker noted, adding that she didn’t see any reminders from the city in the mail this year.

She said the situation has caused unnecessary frustration for some homeowners, who now need to work with the city to resolve the situation.

“It is just frustrating to try and sort this out with such a large, busy office,” said Walker, who has already filed a Notice of Complaint online. “I certainly don’t want to have to go down to city hall to speak to someone.”

Walker is one of many Toronto homeowners who now find themselves in a similar situation after failing to declare the occupancy status of their residence ahead of the deadline, which was initially set for Feb. 29 but later extended to March 15.

The city’s Vacant Home Tax charges owners who leave their properties vacant for more than six months in a calendar year. For 2023, the taxation rate is one per cent, meaning that the tax for a property valued at $1 million is $10,000.

In the 2024 tax year, and every year after, the tax rate will be three per cent (i.e. $30,000 on a $1 million home).

While the vast majority of homeowners in the city will not be required to pay the tax as their homes are occupied, every homeowner who did not declare by the deadline is required to pay a $21.24 fee.

“It is a bit of a backwards situation that we are having to declare that our property is not vacant,” Walker said.

Homeowner ‘distressed’ by huge tax bill

Sophie Lem, a Riverdale resident, said she too was unaware that the declaration had to be made every year. Last month, she said she received a Vacant Home Tax bill for more than $12,000.

“I’m just furious, and I’m upset, and distressed at the same time,” she said, adding that it is obvious from the utility bills that the residence is occupied. “A good cross-reference is the water bill.”

Lem said she filed a complaint online and tried to contact her local councillor but has not heard back.

On the bill, Lem said, she is told to make her first payment of more than $4,000 by May 15.

“I don’t know what to do,” she said.

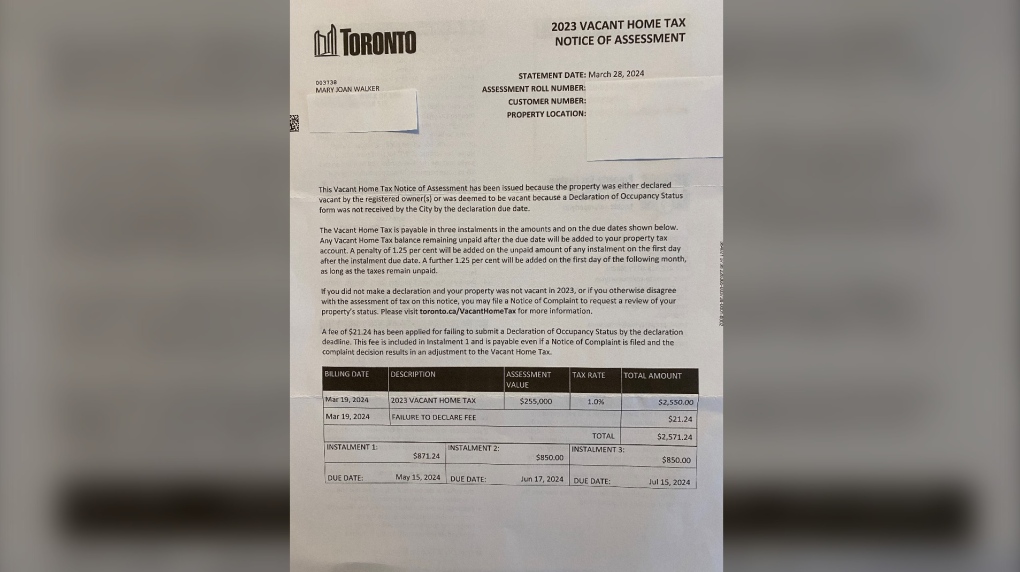

A Vacant Home Tax bill is seen above. (Mary Walker/ Submitted)

A Vacant Home Tax bill is seen above. (Mary Walker/ Submitted)

Ward 12 Coun. Josh Matlow urged residents in this situation not to pay the bill while the city works to resolve the issue.

“You are going to receive an updated notice to inform you about the next steps. If you do have utility bills, proof that you live there, certainly send it in but I do know that they mayor and city staff are working this out because there is a recognition that this is not done well,” he told CP24 on Thursday.

Implementation a ‘mess’

Matlow called the declaration process “flawed,” “clumsy,” and unfairly “punitive.”

“This is just a demonstration of an idea that had merit but has not been implemented well,” he said.

“The Vacant Home Tax is being used by cities as a tool to identify where there are investment properties that are just sitting around, sitting vacant that really should be used as homes in the midst of a housing affordability crisis. So it is a useful tool.”

But he said the implementation of it has been “a mess.”

“It is our job to guide and direct city staff to come up with a process that is fair, understandable, reasonable, and isn’t punitive when somebody simply didn’t know to do something.”

He said people faced with unexpected tax bills for “thousands and thousands of dollars” are “understandably upset.”

Matlow added that conversations are underway about how the city can better identify properties that are vacant.

“There should be a way to identify, for example, through the utility bill… where if you are using electricity and water that should suggest that someone is living there,” he said.

“We need to have a process that doesn’t depend on people every single year having to either remember or be prompted to make a declaration.”

As of yesterday at approximately 5 p.m., the City had received over 25,000 Notices of Complaint from property owners claiming that their property is occupied despite receiving a Vacant Home Tax Notice of Assessment, a spokesperson for the city said in an email to CP24.

In 2022, there were 2,336 property owners who declared their residential units vacant, while 44,902 other properties were initially deemed vacant by the city because no declaration was made. Late declarations received through a complaints process eventually reduced the number of homes deemed vacant to 17,437.

CP24.com has reached out to the city for comment and updated information on the number of vacant properties in Toronto in 2023 but has not received a response.

-With files from CTV Toronto’s Phil Tsekouras